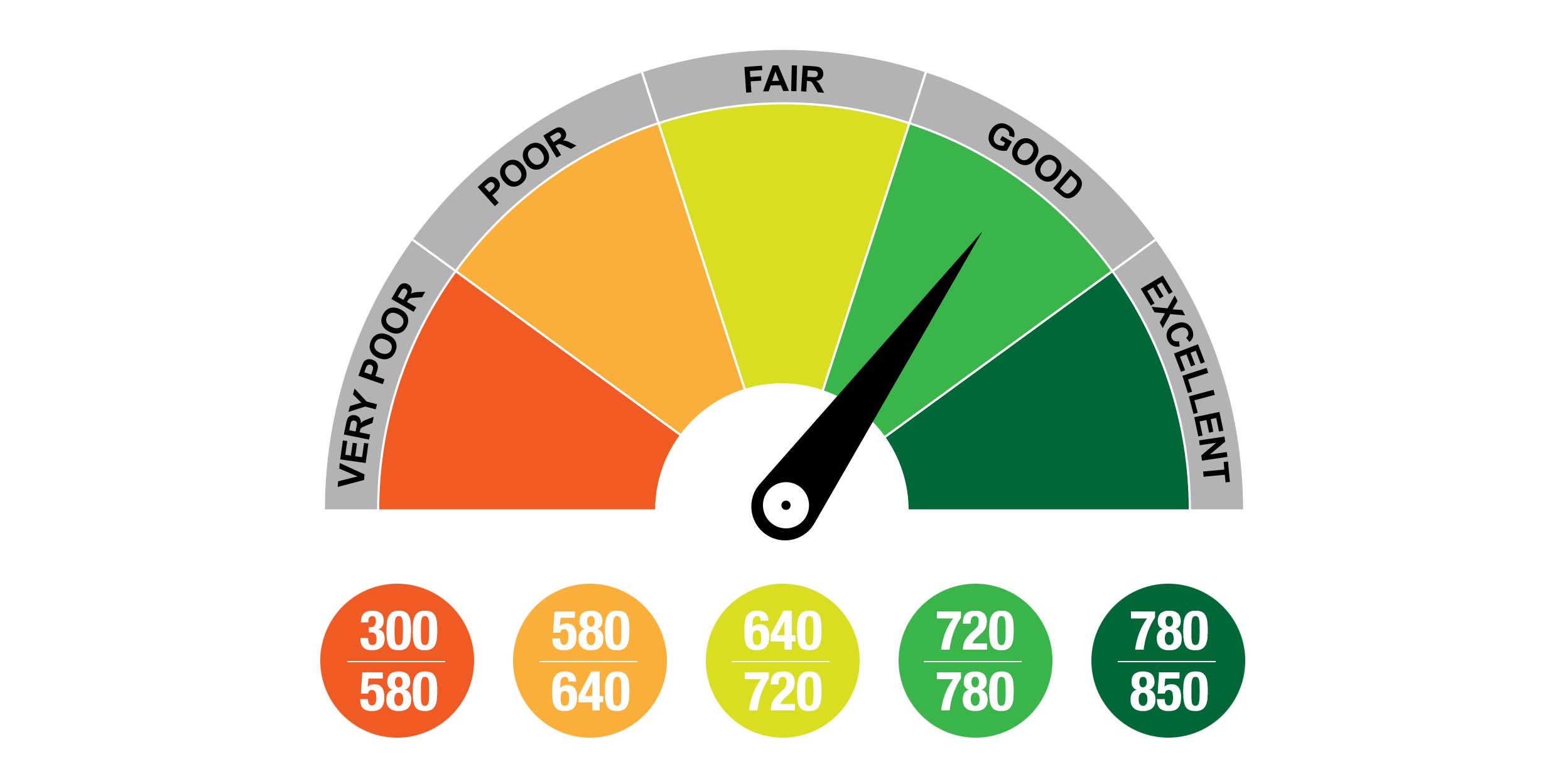

Credit score isn’t just a figure; it is a direct testament of your credibility. It is one of those numbers that you’d always want to keep high if you want to be in the good books of loaners, banks, and credit card companies, because they use this very figure to evaluate the level of risk in lending to you, and to check if you are able to manage your debt or not.

With that said, it is implicit that the higher the credit score, the better are your chances of getting accepted for credit at the best rates. On the contrary, a bad credit rating will fetch you hefty interest rates and worse deals, and/or result in failure to qualify for credit at all.

So, what really affects your credit score then?

A lot many factors than you think.

Late payments: Being late and/or missing a credit card payment or a loan repayment will show up as a bad mark on your credit file.

Minimum payments: Making only the minimum payments each month also blemishes your record, as it suggests that you are struggling to manage your debts.

IVA or bankruptcy proceedings: This one goes without saying. You will almost certainly have a low credit score if you are declared bankrupt or enter into an Individual Voluntary Arrangement (IVA).

CCJs: Let’s just say, lenders do not make the best of friends with borrowers who have a County Court Judgment (CCJ) against their name, because these are used by lenders to claim money back in a legal procedure.

Little or no financial history: Having no credit history makes it difficult for you to borrow money as there’s no way for the lender then to assess your creditworthiness.

Easy access to available credit: People who borrow relatively small amounts or who prudently pay off their credit card bills in full each month are not quite profitable for lenders.

Access to large credit: Likewise, having access to large amounts of credit could worsen your score, as there is a possibility you might draw down a lot in a short space and struggle to service the debt.

Frequency of credit applications: Applying repetitively for credit sends across the impression that you are in a financial crisis. Thus it is important to limit your applications, especially if you were recently turned down.

Refused credit: This can be more frustrating than it appears as the lender isn’t obligated to give you a reason for refusal. However, you should always ask as this might give you a broad hint – which you can then check on your credit file. Also, the timing of your application could affect your score. So don’t be surprised if you are refused credit shortly after moving home or switching jobs, as lenders look for stability and can be put off by any recent changes.

The above listed points can sound intimidating. Sure. But there’s an upside after all. These fallings do not stay on your report forever. A missed payment on your credit card will usually be wiped off after three years, and details of a CCJ or bankruptcy should remain on your file for six years or so.

[Compare the best Credit Cards and Personal Loans Now!]

How to boost your Creditworthiness?

Having discussed the factors that impact credit score, wouldn’t it be nice to shed some light on the ones that improve it, especially given the fact that there is no such thing as a credit blacklist or a universal credit scoring system.

Demonstrate your financial stability

The key to improving your credit rating is to manage your debts well. Don’t miss any monthly payments, stick to the payment deadline, and stay within your credit limit.

Check your credit report annually

Review your report each year to ensure all the information held about you is correct. And of course amend any errors if you spot them.

Close down old accounts

You might owe nothing on the cards, but the lender will look at all your available credit before it makes a decision on your application. So make sure your slate is wiped clean.

Cut financial links with previous partners

If one of your partners in joint financial products has a bad history, it could tarnish your creditworthiness as well merely by association.

Consider a credit builder card

Perversely, the best way to (re)build your credit worthiness is to get credit and use it properly. Prove you can manage your debts sensibly and improve your score. Interest rates on credit cards for low credit scores are usually high, so only consider this option if you can keep your borrowing under control.