If you’re new into the complex conundrum that financial management is, you should probably just rote learn three numbers – 50/20/30 Rule – which, if deployed correctly, serve as a brilliant financial planning tool.

So, how does it help really?

Well, it is a simple guideline – a bifurcation that categorizes your spending and puts a cap on them. Following this rule—if your situation allows for it — can do wonders for your long-term financial health.

Okay, so what do we do actually?

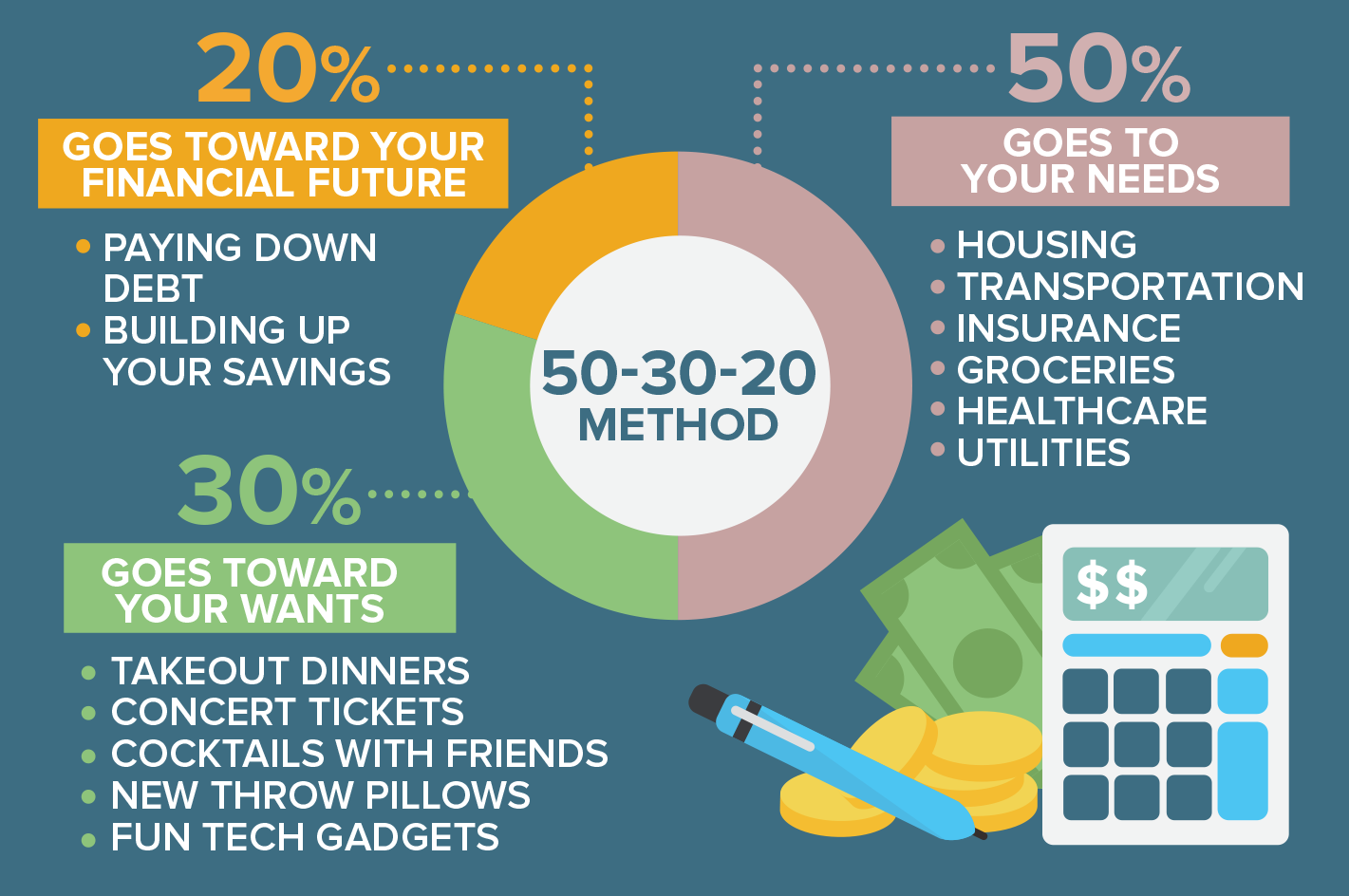

According to the 50/20/30 rule, you must divide your money into three categories upon receiving a paycheck:

your essential needs,

your wants,

and your savings and debts.

50%: Your Needs

Per the rule, you are allowed to devote half of your net earnings to your needs, and when we say needs, we’d like you to leave the wants aside as the latter can often cloud your judgment. How do you separate needs from wants? Follow this: Any payment that could negatively impact your quality of life—or your credit rating—should be treated as a need.

Once you have your needs – your essentials – give them 50% of your paycheck. These could be utilities, groceries, rent, prescription medications, gas for your car, the minimum payment on your credit card, etc.

20%: Your Savings & Debt

Under this block, let’s focus on paying off the past and investing in the future. Sounds idealistic, right?

Precisely why you must do it! Set aside the next 20% of your earnings for debt repayments and savings.

This could include student loans, credit card payments, and retirement accounts, to name a few, whilst also building a safety net with savings in case things go south and expenses increase.

30%: Your Wants

The last chunk should be for the category we ruthlessly absconded earlier – the wants. Go on and spend the residual 30% on things that you want but could fairly live without. This 30% allows for flexible spending and, perhaps, a happier life.

Examples under this block could be money for vacations, shopping sprees, or a car you really covet.

Why are these happy wants placed in the end, you may ask? Rightly done so, as if in a particular month, your needs exceed the allotted 50%, and your savings which must stay a constant, continue staying at 20%, then you are consequently left with little room for wants which are, after all, flexible.

Words of Caution:

It is important to note here that the 50/20/30 Rule can serve its turn only when the percentages for essentials and flexible spending are the maximum that you spend. Falling under these guidelines will leave you with more money for other financial goals.

Let us know how the 50/20/30 pans out for you!